Elon Musk’s $135 Billion Disappearance: A Strategic Sacrifice for a Greater Vision

In a shocking development, Elon Musk has witnessed a staggering $135 billion evaporate from his net worth, yet he remains remarkably unfazed by this monumental loss. Instead of retreating into the shadows of financial despair, Musk is doubling down on his ambitious vision, focusing on building something far more significant than mere wealth. This situation is not unprecedented for Musk; his financial journey has been marked by dramatic fluctuations, but his resilience and forward-thinking mentality continue to propel him into uncharted territories.

Musk has always existed at the intersection of genius and madness, intelligence and recklessness, innovation and chaos. Over the past few months, the immense decline in his net worth—one of the largest personal losses in recent financial history—has raised eyebrows and sparked debates. At first glance, it appears to be a typical case of a tech billionaire facing the wrath of the stock market. However, history has taught us that with Musk, appearances can be deceiving.

The primary catalyst for Tesla’s stock decline—over 37%—is a confluence of factors, including dwindling sales, fierce competition from Chinese automakers, and increasing skepticism regarding Musk’s focus. While these market dynamics are real and quantifiable, they do not fully encapsulate the complex narrative unfolding behind the scenes. The issue extends beyond disappointing quarterly reports or shifting consumer behavior; it reflects a fundamental transformation in Musk’s vision for the future and where he intends to invest his resources.

In recent years, Musk has gradually repositioned himself from being merely an “electric vehicle guy” to becoming a true architect of a post-industrial society driven by artificial intelligence (AI). His companies—Tesla, SpaceX, Neuralink, and the recently launched xAI—are not just businesses; they are platforms for his grand vision of the future. While Tesla investors are clamoring for reassurance, Musk appears more engaged with his AI startup, xAI, than with battery technology or gigafactories. This shift in focus has led to significant investments in projects like Grok, a new generative AI model, which Musk believes can reshape not only the transportation industry but also the very fabric of artificial intelligence itself.

Critics argue that Musk’s scattered focus indicates a lack of commitment to Tesla, suggesting that his erratic leadership is detrimental to shareholders. They point to his tweets about Mars and his involvement in AI discussions as signs that he is becoming increasingly detached from the realities of his automotive empire. However, this perspective may overlook a more profound narrative—one where Musk’s apparent financial collapse is not a failure but rather a strategic sacrifice for a larger purpose.

What if the $135 billion loss is not simply a setback but a recalibration of Musk’s strategy? Throughout his career, he has made bold moves that initially seemed reckless but ultimately proved to be pivotal in his journey. For instance, selling Tesla stock to acquire Twitter may have seemed like a billionaire’s whim, yet it allowed him to gain control over a digital platform that he now plans to integrate with AI, payments, and communications. Similarly, his founding of The Boring Company, once viewed as a joke, is now quietly influencing urban infrastructure development.

Tesla may have catapulted Musk to the status of the world’s richest person, but in his vision, it may only be the beginning. With the electric vehicle market maturing and competition intensifying, Musk appears less concerned with defending his existing territory and more focused on exploring new frontiers. The emphasis is shifting from tangible assets to intangible innovations, from machines that move people to algorithms that think. According to Musk, the real boundaries lie not on roads or in space but within neural networks and large language models that will redefine industries in the coming decades.

While the market panics over stock fluctuations and balance sheets, Musk may be playing an entirely different game. In this narrative, Tesla’s recent downturn is not a reflection of incompetence but rather a deliberate effort to streamline his focus before launching into new domains. However, this strategy is not without risks. Unlike Musk’s previous high-stakes gambles, this one affects millions of investors, employees, and stakeholders. Tesla is not a side project; it is a publicly traded company with significant global implications.

The question now is whether Musk can maintain control over his ambitious vision or if he risks losing grip on the very empire he has built. Signs of chaos are emerging, as Tesla’s decline has shaken investor confidence. The rapid evolution of AI technology is occurring at an unprecedented pace, and Musk’s companies are racing to keep up with competitors like OpenAI and Anthropic. Additionally, the political landscape is shifting, with regulators increasingly wary of billionaires who see themselves as architects of humanity’s destiny.

Despite these challenges, Musk retains substantial cultural and technological capital. He continues to attract top talent, inspire fierce loyalty, and generate media attention with a single tweet. In a world where influence can sway markets, Musk remains one of the most impactful individuals alive.

So, what should we make of the $135 billion? Is it a sign of decline, distraction, or something else entirely? Perhaps it is all three. Perhaps it is a manifestation of what happens when someone perpetually ahead of the curve finally encounters the limits of market tolerance. Or maybe it is merely a temporary dip in a long game that most of us are still trying to comprehend. If there is one lesson to be learned from Elon Musk, it is that the path to the future is never straightforward, never smooth, and never cheap.

News

DECODING THE MYSTERY: Ancient records reveal that “Torenza” existed before the Common Era: a lost civilization, erased from history, reappeared… twice.

In the depths of forgotten excavations, an ancient secret has emerged to challenge everything we thought we knew about human…

“NASA detects unidentified objects escorting comet 3I/Atlas: panic or revelation?”

In the classified NASA records dated June 12, 2042, lies an event that has shaken the foundations of our understanding…

THE GRIM DEATH OF JAPANESE GENERAL MASAHARU HOMMA – The Prime Culprit of the Bataan Death March That Killed 10,000 People and His Last Words to the Japanese That Will Resonate Through the Millennia.

Content Warning: This article discusses historical events related to war crimes and forced marches that resulted in significant loss of…

THE PRICE OF 300 LIVES: The Horrifying Final Moments of the “King of the Decapitators” – Japan’s Most Notorious War Criminal.

Gunkichi Tanaka, a captain in the Imperial Japanese Army, became famous for his role in the Nanjing Massacre, where he…

THE DAY A NAZI LEARNED FEAR: Rudolf Beckmann – The Nazi beast of Sobibor screamed in fear as he was murdered by his Jewish victims as he rose up against the concentration camp.

Content Warning: This article discusses historical events related to extreme violence, war crimes, and the Holocaust, which may be distressing….

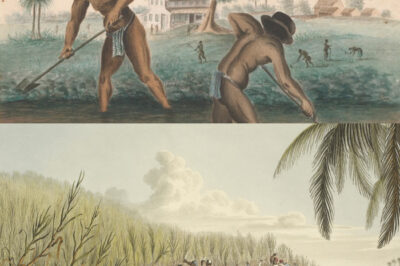

This 1859 plantation portrait looks peaceful—until you see what’s hidden in the slave’s hand.

This 1859 plantation portrait looks peaceful, until you see what’s hidden in the slave’s hand. The Photograph That Shouldn’t Exist…

End of content

No more pages to load